Blog: C-Suite Brexit Impact Survey Reveals Startling Contrasts

Published: 19th April 2018

Author: Anish Gupta, Director

The Leadership Gallery recently conducted a survey of CEOs and C-Suite executives to understand how they viewed the implications of Brexit for their organisations. The results are in, and they provide an interesting insight into organisations’ priority areas of concern.

The majority of respondents (74%) indicate they are already planning for the possible consequences of Brexit, and across the sample, about two thirds of respondents believe that Brexit will not pose a significant threat to their business strategy.

While this sounds like a resounding vote of confidence in UK industry’s ability to deal with life after Brexit, a closer analysis of the responses shows there are sharp differences of opinion depending on sector.

At a headline level, the UK appears to be confident that the threats posed by Brexit are not huge. However, this masks serious concerns within certain sectors. Let’s take a look at each of the issues polled separately.

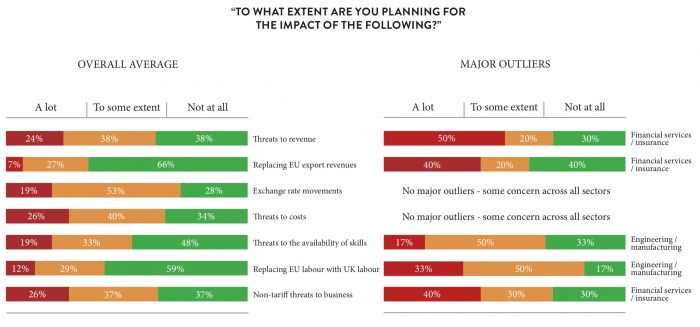

Threats to revenue

76% of respondents feel that threats to revenue are limited or not serious. However, in the finance and insurance and consulting/tech services sectors, over 70% of responses admitted concern, with 50% being seriously concerned. Uncertainty over the future of regulation is likely a major contributor to this, as the UK is currently subject to over 40 financial services-related EU regulations and directives, and it remains to be seen which it will continue to align with post-Brexit.

Ability to replace revenues from exports to Europe that may be lost after Brexit

There is an overwhelming sense of confidence that this will not be a serious threat (66% saying ‘not at all’). However, financial services and insurance were again outliers, with 40% of respondents feeling the threat is very serious. Businesses should keep their ears to the ground with regard to the eventual terms of a trade deal between the UK and EU, and scenario plan around a number of factors.

Threats from movements in exchange rates

This one is an exception. Over 70% of respondents across all sectors see the risk of impact on exchange rate as a high or very high concern. We have already seen volatility since the announcement, and so this reaction may be a reflection of what businesses have already seen crystallising.

Threats to costs

66% of respondents are highly or very highly concerned about the impact on costs. This is reflected most in responses from financial services and insurance, engineering and manufacturing, retail (including food) and marketing services and advertising. Largely, industries with complex supply chains, or where sub-assemblies move back and forth between the UK and EU several times showed the highest concern in this area. How supply chains need to be augmented is not yet clear, so firms will need to stress test different possible outcomes.

Threats to availability of skills

Across sectors, there is a high level of confidence that this will not be an issue. The exception is in engineering and manufacturing, where 67% of respondents see this as a moderate (50%) to high (17%) threat. The eventual incarnation of immigration and trade law after Brexit could make obtaining and maintaining a wide range of capabilities a challenge, and so firms should be thinking about multiple possible scenarios when it comes to their post-Brexit capability requirements. Businesses may have to look at different ways of fostering or obtaining the skills they need.

Plans to replace skilled EU labour with UK labour

Across sectors, there seems to be no clear threat perception. The only sector that sees this as a potential issue to prepare for is engineering and manufacturing, with over 80% seeing it as a moderate to high threat. Again, immigration law will largely determine whether this becomes an issue.

Threats from non-tariff barriers post Brexit

There are divided views on whether this will be a major threat. Specifically, engineering and manufacturing (83%), and financial services and insurance (60%) have flagged this as a serious concern.

An overview of the results:

“To what extent are you planning for the impact of the following?”

The results above are from 58 respondents from the following sectors: Advertising, Aviation, Business Services, Construction, Consultancy, Consumer Goods, Engineering, Finance & Financial Services, FMCG, Food, IT, Insurance, Market Research, Property, Technical services, Transport, Video Publishing.

Summing it all up

On one level, the responses show a degree of confidence about the post Brexit world. However, there was a noted increase in concern around issues which have already partially materialised, such as exchange rate movement. This arguably represents a warning for businesses around the other, more complex, issues that were the subject of the survey questions.

Where other issues are yet to become clear, there is an opportunity for businesses to intervene and take steps to build their understanding of, and strategies to meet the threats. It is illuminating that engineering and manufacturing and financial services and insurance, which between them account for over a quarter of the UK’s jobs and exports, are more than moderately concerned about many of the issues.

We would recommend that all sectors carry out formal assessments and plan ahead for possible scenarios.

The Leadership Gallery specialises in helping businesses take the risk out of executing their strategies. Brexit is no exception.